Article content

(Bloomberg) — Asia’s benchmark share index is set to slip from a record high after declines on Wall Street, where investors rotated out of richly valued technology stocks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

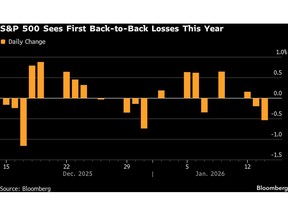

Equity-index futures for Japan, Hong Kong and mainland China all declined after the tech-heavy Nasdaq 100 Index dropped 1.1% on Wednesday. The S&P 500 closed 0.5% lower due to losses in the tech megacaps, even as a majority of companies rose.

Article content

Article content

Article content

Oil fell after President Donald Trump said he had been assured Iran would stop killing protesters in a signal he could hold off on a threatened military response to the repression of demonstrations. West Texas Intermediate was down as much as 3% after settlement on Wednesday. Elsewhere, gains in Treasuries pushed the 30-year yield to the lowest level this year. Metals extended their recent rally, with gold, silver and copper rising to records.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Asian shares have outpaced gains on Wall Street this year on relatively cheaper valuations and continued bets on the artificial-intelligence trade. In contrast, the first weeks of the year in the US have been marked by a rotation out of giant tech companies, whose all-weather earnings made them safe bets at times of economic uncertainty.

Article content

“This is a demonstration of what occurs when rotation affects the stocks that dominate key indexes,” Steve Sosnick, chief strategist at Interactive Brokers, wrote in a note.

Article content

Meanwhile, the US Supreme Court didn’t rule on challenges to Trump’s tariffs Wednesday, leaving the world to wait until at least next week to learn the fate of his signature economic policy.

Article content

Article content

Also on Wednesday, as earnings rolled in, Wells Fargo & Co. sank after missing profit estimates while concern about Bank of America Corp.’s expense outlook offset solid results. Citigroup Inc. slipped as top executives reined in analyst exuberance about the bank racing toward the finish line on key regulatory requirements and reducing its expenses.

Article content

“The expectations for this earnings season are very high,” said Matt Maley at Miller Tabak. “If those expectations are not met in today’s stock market — which is priced for perfection — it’s going to create some headwinds.”

Article content

While the S&P 500 fell amid a slide in all “Magnificent Seven” shares, more than 300 of its firms actually rose. Small caps continued to outperform, with the Russell 2000 beating the S&P 500 for a ninth straight session — matching the longest streak since 1990.

Article content

Treasuries remained higher after a batch of economic data was seen as unable to justify a shift in expectations for monetary policy. Money markets continued to project the next Federal Reserve rate cut only in mid-2026.

Article content

On the macro front, US retail sales rose in November by the most since July, fueled by a rebound in auto purchases and resilient holiday shopping. Wholesale inflation picked up slightly on a jump in energy costs, even as prices for services were unchanged.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)