Article content

(Bloomberg) — Asian equities may struggle for direction when trading opens on Thursday, tracking a flat session on Wall Street with traders assessing simmering economic and geopolitical risks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Equity index futures for Hong Kong and Australia fell while those for Japan were little changed. Contracts for US stocks opened flat in Asian trading after the S&P 500 ended Wednesday unchanged. The Nasdaq 100 rose 0.2%, helped along by a record high for Nvidia Corp. shares. Micron Technology Inc. shares rose in after-market trading following an upbeat forecast.

Article content

Article content

Article content

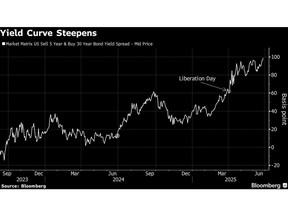

Short-dated Treasuries rallied, bringing the two-year yield four basis points lower, while long-dated US government debt was broadly unchanged. The dollar slumped to trade near its three-year low on Wednesday. Oil held onto gains following its biggest two-day decline since 2022.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The moves reflected a sense of uncertainty as investors grappled with an uneasy ceasefire in the Middle East and the inflationary effects of US tariffs. Despite stabilizing prices, the oil market is still volatile, with Russia open to another output hike at the next OPEC+ meeting, and US President Donald Trump’s comments on Iranian sanctions causing concerns.

Article content

Federal Reserve Chair Jerome Powell said Wednesday that the US central bank is struggling to determine the impact of tariffs on consumer prices. Powell said it was “very hard to predict” the inflationary impact of the levies, in Senate testimony after Fed officials left rates steady last week.

Article content

“If it were not for the uncertainty created by shifting trade policy, the Fed may have been able to cut interest rates this summer,” said Carol Schleif at BMO Private Wealth. “The Fed’s pause on interest-rate cuts is tariff induced, and not necessarily reflective of economic progress. We expect one to two cuts in 2025, starting most likely in September.”

Article content

Article content

Trump said the US would hold a meeting with Iran next week but cast doubt on the need for a diplomatic agreement on the country’s nuclear program, citing the damage that American bombing had done to key sites.

Article content

His comments came on day two of a ceasefire between Israel and Iran, ending 12 days of conflict that threatened to escalate into a wider regional war and upend energy markets.

Article content

“The markets are pricing in that the worst of the Iran/Israel conflict is behind us,” said Schleif. “Tariffs, trade, tax, inflation, employment and interest rates have a lot more sway on stocks right now.”

Article content

In Asia, Hong Kong’s de facto central bank bought the local dollar to prop it up on Thursday, in a move to defend the city’s currency peg to the greenback.

Article content

Gold was little changed early Thursday after rising 0.3% Wednesday. Bitcoin was broadly stable around $107,500.

Article content

Short-Term Breather

Article content

Despite the tumult of the past few weeks, the S&P 500 is within touching distance of its record high, while a gauge of global stocks touched a new peak on Wednesday. For some, the gains are beginning to stretch valuations and multiples are starting to look frothy.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)