Article content

(Bloomberg) — Asian stocks edged up at the open Friday, poised for a fifth consecutive day of gains, as technology shares lifted Japanese equities.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The MSCI Asia Pacific Index rose 0.5%, helped by a 1.3% rise in the Nikkei-225 index. Sony Group Corp. and Softbank Group Corp. led the gains after reporting earnings. Contracts for US stocks edged higher. Treasuries were little changed while oil headed for a 5% weekly slump.

Article content

Article content

Article content

The dollar slipped for a sixth consecutive session Friday, poised for its longest losing streak since March 2024. The yen pared gains as Japan’s chief trade negotiator said the US agreed to end so-called stacking on universal tariffs and cut car levies at the same time.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

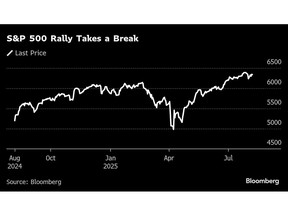

Asian shares are poised for their best week since June amid speculation of an interest-rate cut by the Federal Reserve. Investors have also grown optimistic about corporate earnings, which has helped the S&P 500 advance 30% from the lows in April, when President Donald Trump announced his tariff blitz.

Article content

Meanwhile, Trump signaled new sanctions on Russia could land as early as Friday. Treasury Secretary Scott Bessent also added that China levies “could be on the table” over the buying of Russian oil.

Article content

The gains in Asia came after the S&P 500 closed Thursday little changed, halting a rally that drove stocks to the brink of a record.

Article content

Whether or not the blistering rally in American equities is about to cool, some big firms have warned clients to prepare for a near-term pullback amid sky-high valuations. Added to bulls’ worries is seasonality. August and September have historically been the two worst months for the S&P 500.

Article content

Article content

“We talk about the potential for ‘air pockets’ in this current environment based primarily on headline risk, which remains elevated in our view,” said Dan Wantrobski at Janney Montgomery Scott. “This renders them vulnerable to pullbacks as we enter the second half of 2025.”

Article content

Australian bonds slipped, tracking Treasuries after Thursday’s $25 billion bond sale followed poor results for three- and 10-year debt auctions this week.

Article content

On the economic front, US continuing jobless claims surged to the highest since November 2021, adding to recent signs that the labor market is weakening.

Article content

Meantime, Federal Reserve Governor Christopher Waller is emerging as a top candidate to serve as the central bank’s chair among President Trump’s advisers as they look for a replacement for Jerome Powell, according to people familiar with the matter.

Article content

Trump said he had chosen Council of Economic Advisers Chairman Stephen Miran to serve as a Fed governor. The US president said that Miran, who will need to be confirmed by the Senate, would only serve the expiring term of Adriana Kugler, which expires in January.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)