Article content

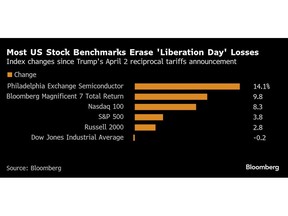

(Bloomberg) — Stocks in Asia are poised to extend this week’s rebound after US benchmarks wiped out 2025’s losses on signs that President Donald Trump’s trade war is cooling and as inflation data showed limited impacts so far.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Futures pointed to advances in Sydney, Tokyo and Hong Kong in early Wednesday trading. Chipmakers led the rally on Wall Street, as Nvidia Corp. and Advanced Micro Devices Inc. are set to supply semiconductors to Saudi Arabian firm Humain for a massive data-center project.

Article content

Article content

Treasuries erased gains on speculation the Federal Reserve will stay put as it evaluates potential implications of tariffs. The dollar erased most of Monday’s advance. Oil climbed as Trump ratcheted up the rhetoric against Iran’s nuclear program.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The easing of trade tensions and a surprisingly positive earnings season have spurred optimism after a period of doubt about Corporate America’s ability to meet high profit expectations. The stock market is “gonna go a lot higher,” Trump said, citing an “explosion of investment and jobs” as he said Saudi Arabia would commit to investing $1 trillion in the US.

Article content

The Trump administration plans to overhaul regulations on the export of semiconductors used in artificial intelligence, tossing out a Biden-era approach that had drawn strenuous objections from America’s allies. The US is also weighing a deal that would allow the United Arab Emirates to import more than a million advanced Nvidia chips, people familiar with the matter said.

Article content

After mostly missing out on last month’s rebound, investors are likely to be forced to chase the stock rally sparked by this weekend’s US-China trade truce, Bank of America Corp. strategists said. A survey conducted before the trade talks in Geneva showed fund managers were a net 38% underweight on US stocks, the most in two years.

Article content

Article content

The poll is “bearish enough to suggest pain trade modestly higher” given the US-China deal would prevent a recession or a shock in credit markets, BofA strategist Michael Hartnett wrote.

Article content

The S&P 500 rose 0.7%. The Nasdaq 100 climbed 1.6%. The Dow Jones Industrial Average lost 0.6%. The Bloomberg Magnificent Seven index of megacaps added 2.2%.

Article content

The yield on 10-year Treasuries was little changed at 4.47%. The Bloomberg Dollar Spot Index fell 0.7%. Brent crude added 2.6%.

Article content

US inflation rose by less than forecast in April amid tame prices for clothing and new cars, suggesting little urgency so far by companies to pass along the cost of higher tariffs to consumers.

Article content

The temporary agreement reached over the weekend to de-escalate the trade war with China has largely scaled back projections of how much damage tariffs will inflict on the economy. JPMorgan Chase & Co. boosted its forecast for US growth, dropping its earlier call that the world’s largest economy would sink into a recession in 2025.

Article content

While derivative contracts continue to price in two quarter-point rate cuts by the Fed this year, several major Wall Street banks this week forecast a rate cut in December, later than they previously anticipated.

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)