Article content

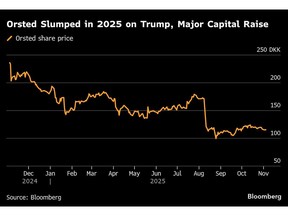

(Bloomberg) — Orsted A/S shares were little changed Tuesday after Apollo Global Management Inc. agreed to invest $6.5 billion in the Danish company’s Hornsea 3 offshore wind farm in the UK, the latest in a string of major European energy deals for the US private equity firm.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The investment is a vote of confidence in Orsted as it works to complete a series of large projects and refocus on Europe following costly setbacks in the US. Hornsea 3 is Orsted’s biggest wind farm under construction, making its successful delivery key to the company’s recovery and future growth.

Article content

Article content

Article content

Shares in the company were little changed in early trading in Copenhagen as the company had flagged that a deal would likely happen this year.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The farm-down of Hornsea 3 is an extremely important turning point in the recovery of Orsted’s finances, together with the successfully completed capital increase,” Jacob Pedersen, head of equity research at Sydbank A/S, wrote in a note.

Article content

The so-called farm down was part of a divestment program planned by chief executive, Rasmus Errboe, when he took over the company to try to turn it around. The plan was overtaken by events in the US that sent the company into crisis mode. Orsted’s management will be hoping that the deal shows the start of a return to normality for the company after the completion of a $9.4 billion capital raise last month.

Article content

The process began more than a year ago, Bloomberg reported at the time. Seeking an equity partner is a common way of funding huge wind projects. The project has a government support contract that will kick in once it starts generating. Under the deal Orsted is assuming all the risk of delays and cost overruns, according to analysts.

Article content

Article content

For Apollo, it’s the latest in a series of investments in energy in Europe, a region where the firm has taken an increasingly bullish view. In addition to the Orsted deal, earlier this year it also made a €3.2 billion ($3.7 billion) deal for a stake in RWE AG’s German power grid business and agreed to help Electricite de France SA raise as much as £4.5 billion ($5.9 billion) in private bond placements to fund the construction of the Hinkley Point C nuclear power plant and other investments in the UK.

Article content

The Hornsea 3 deal will see Apollo take a 50% stake in the project and fund 50% of the remaining investment needed to build the project. Once it’s complete, the wind farm has a contract to sell electricity at fixed prices for 15 years. During much of that period, Apollo will get the majority of the cashflow.

Article content

“This is effectively a transaction that prioritizes capex sharing, as opposed to value creation,” Jenny Ping, analyst at Citi, wrote in a note.

Article content

.jpg) 5 hours ago

3

5 hours ago

3

English (US)

English (US)