Article content

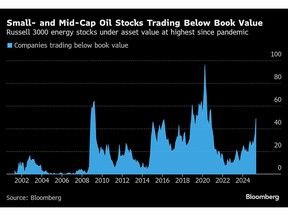

(Bloomberg) — Here’s something you don’t see in the market too often: A third of all mid- and small-cap oil and gas stocks in the US are now trading below their book values.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

That’s the highest level since the pandemic. And it’s a gift for value investors worshiping the gospel of Warren Buffett and his mentor, Ben Graham, who referred to these kinds of opportunities as “cigar butts.”

Article content

Article content

“We’re going to take advantage of a lot of suckers,” said Cole Smead, CEO of Smead Capital Management, who has been buying additional oil and gas stocks that are trading well below book.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Energy is the S&P 500’s second-worst performing sector in the second quarter and is leading the way lower on Thursday. It has lost roughly 14% since President Donald Trump’s April 2 tariff announcement, as crude prices tumble due to fears of global trade wars sparking economic slowdowns and OPEC member countries boosting production to increase supply. Two weeks ago, West Texas Intermediate crude fell to around $55 a barrel, a level it touched in April and before that February 2021. It has rebounded only modestly since then and remains down about 15% for the year.

Article content

Now, shares of oil and gas companies, including Murphy Oil Corp, Crescent Energy Inc. and Noble Corp., are trading for less than what the assets on their books are worth. That’s the classic definition of value investing, where the stock is priced at less than what the business would be worth if it was stripped and sold for parts.

Article content

Article content

At this point, 33% of Russell 3000 energy stocks are trading below their book values. The figure rose as high as 40% late last week, before the US and China agreed to a 90-day trade truce, which gave a slight boost to oil prices and energy stocks. The last time this happened, it preceded off a two-year run in 2021 and 2022 when energy trounced the market and was the top-performing sector.

Article content

A similar proportion of large- and small- Canadian oil and gas stocks have fallen into the same range. Smead, who is invested on both sides of the border, thinks the stocks are undervalued and poised to at least return to book value, and likely more.

Article content

Buying Cheap

Article content

“I don’t need to have a rosy picture” for the energy outlook to make money trading energy stocks, Smead said.

Article content

Smead isn’t alone in buying on the cheap. A handful of well-capitalized oil and gas companies have indicated they’ll be opportunistic, repurchasing their stock if it has sold off sharply. Cenovus Energy Inc. bought back C$62 million ($44 million) of its own shares in the first quarter and has nearly tripled that to C$178 million in the second quarter so far.

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)